Imagine dropping a ball from a certain height.

The ball will bounce up part of the way, then fall to the floor again.

This bouncing and falling process will continue until the ball comes to a complete stop.

The total distance traveled will be a multiple of the distance covered by the initial fall. This then is the so-called “multiplier effect”.

During an economic recession when the aggregate demand for goods and services falls short of what the economy can produce, the government might inject some spending stimulus into the economy.

The hope is to stimulate consumption and general spending by a multiple of the initial injection.

Let’s look at the spending or expenditure multiplier process in detail.

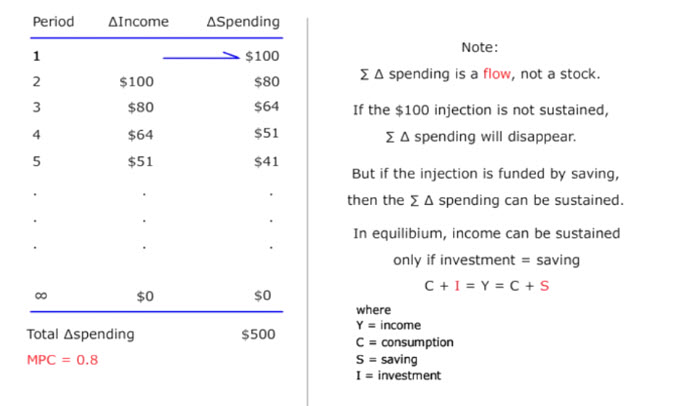

Suppose there is an injection of $100 billion of stimulus into the spending stream in the first round.

This injection adds to income in the second round.

Suppose 100% of this additional income is spent on consumption.

This additional consumption then adds $100 billion of income in the third round.

Suppose 100% of this additional income is spent on consumption.

This additional consumption then adds $100 billion of income in the fourth round.

And so on.

This process can go on forever, adding infinite amount of additional income and expenditure.

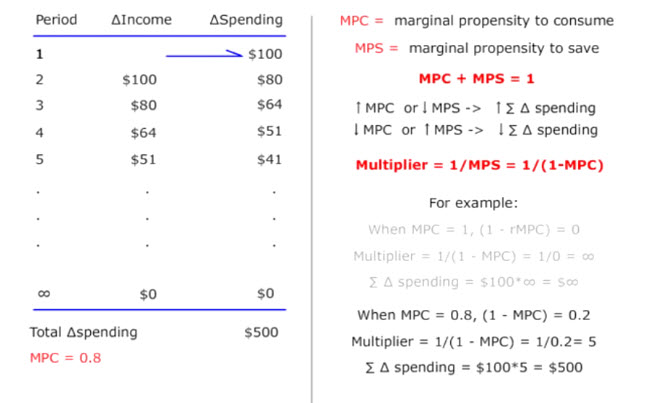

This is so only because 100% of additional income in each round is spent on consumption. This percentage is called the “marginal propensity to consume”. MPC for short.

MPC = 0.8

The story is quite different if the marginal propensity to consume is less than 100%. Let’s say only 80%.

Here we also have an injection of $100 billion of stimulus into the spending stream in the first round.

As before, this injection adds to income in the second round.

Now, only 80% of this additional income is spent on consumption.

This additional consumption then adds $80 billion income in the third round.

Again, 80% of this additional income is spent on consumption.

This additional consumption then adds $64 billion income in the fourth round.

And so on.

When the additional spending is close to zero after many rounds, the multiplier process finally stops. The total additional spending amounts to only 5 times the initial stimulus injection because the marginal propensity to consume is only 80%, instead of 100%.

Multiplier and the MPC

The difference between a multiplier of infinity and a multiplier of 5 thus depends on the magnitude of the MPC.

And the inverse of MPC, namely the marginal propensity to save, MPS.

Since what additional income that is not spent on consumption is saved. In other words, MPC + MPS = 1.

Our two previous examples show that the larger the marginal propensity to consume, or the smaller the marginal propensity to save, the larger will be the multiple of additional spending for a given amount of stimulus injection.

Equivalently, the smaller the marginal propensity to consume, or the larger the marginal propensity to save, the smaller will be the multiple of additional spending for a given amount of stimulus injection.

Thus, the expenditure multiplier can be expressed in equation form as the reciprocal of the marginal propensity to save or the reciprocal of (1 – MPC).

For example, when MPC = 1, the multiplier is equal to infinity. And total additional spending is infinite times the initial stimulus injection.

And when MPC = 0.8, the multiplier is equal to 5. And total additional spending is therefore five times the initial stimulus injection.

Stimulus injection is not a permanent solution

Note that the total additional spending is a flow, not a stock.

In other words, if the injection is not sustained over time, the total additional spending will not be repeated.

But if what is saved, that is the part not spent on consumption, is injected back to the spending stream, then the total additional spending can be sustained.

In general, a given level of income can be sustained only if planned investment is equal to planned saving because what is not spent on consumption must be plowed back into investment to stop the leakage from the income stream.